MARKET

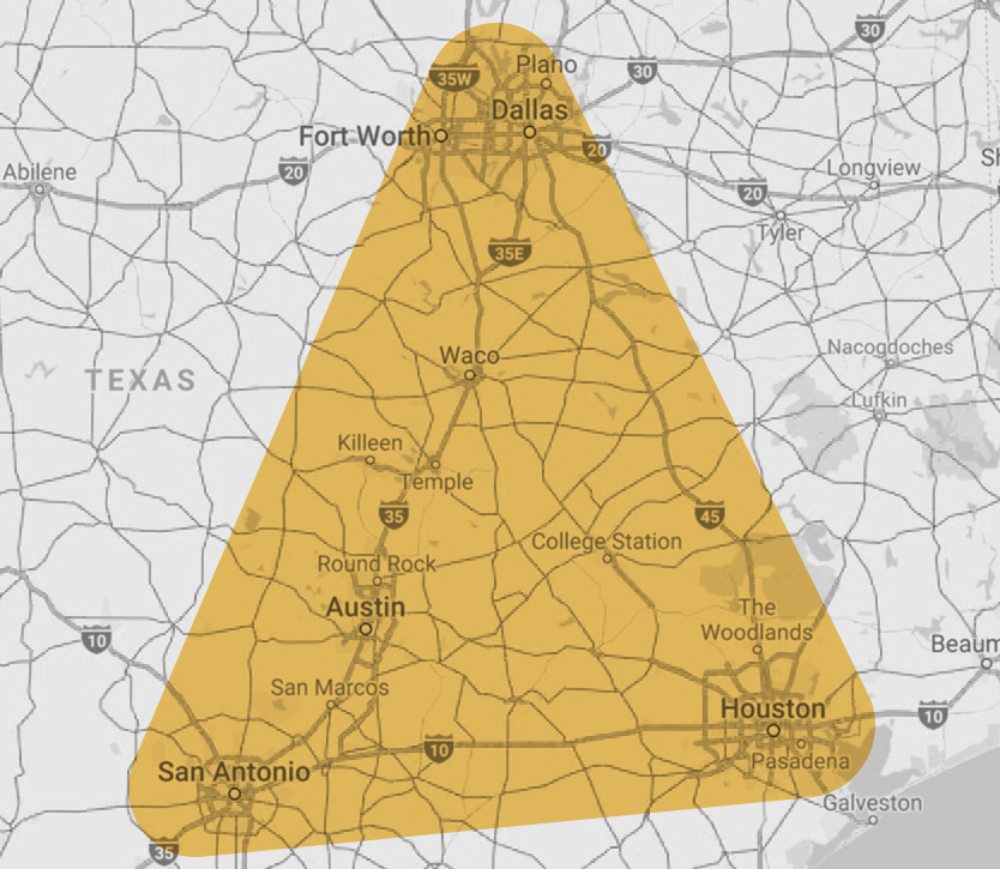

“The Texas Triangle,” including Dallas-Fort Worth, Houston, San Antonio, and Austin, offers compelling opportunities for commercial real estate investment. With significant population growth, a diverse economy, robust infrastructure, business-friendly policies, and a history of real estate appreciation, this region is an attractive choice for investors.

Population Surge: The Texas Triangle is experiencing a rapid population increase, driving demand for commercial real estate across various sectors.

Economic Diversity: With a diverse economy spanning multiple sectors, including technology, energy, and healthcare, the region provides investment stability.

Infrastructure Investment: Ongoing infrastructure development enhances connectivity, logistics and the demand for real estate overall.

Business-Friendly Policies: Texas’ business-friendly environment attracts companies and fuels demand for commercial properties.

Real Estate Potential: Historically, the region has shown strong appreciation potential, making it a promising choice for real estate investors seeking long-term returns.

THE “TEXAS TRIANGLE”

PORTFOLIO

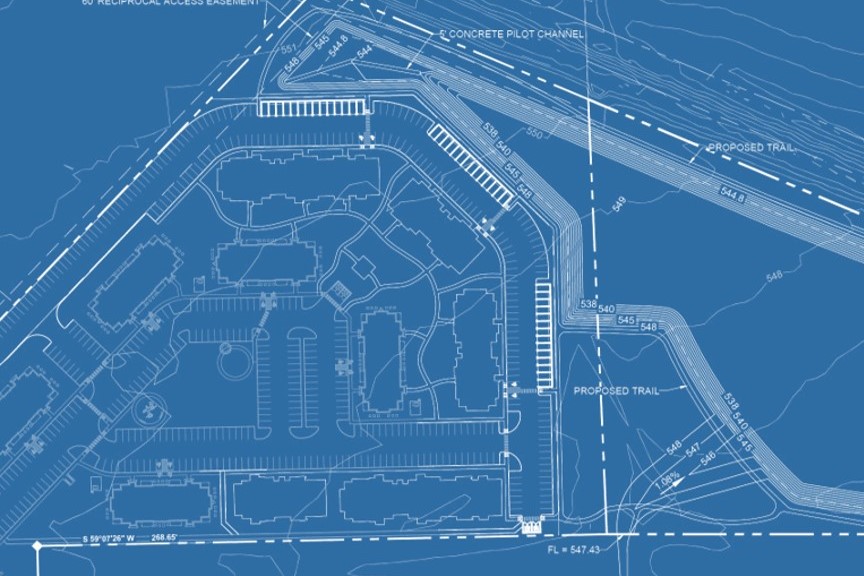

The Grassdale

Manor, Texas

320-unit A Class property developed under the HUD 221(d)(4) program. The Grassdale is an Opportunity Zone project nine miles from Tesla’s Giga Factory. Construction was completed in 2022.

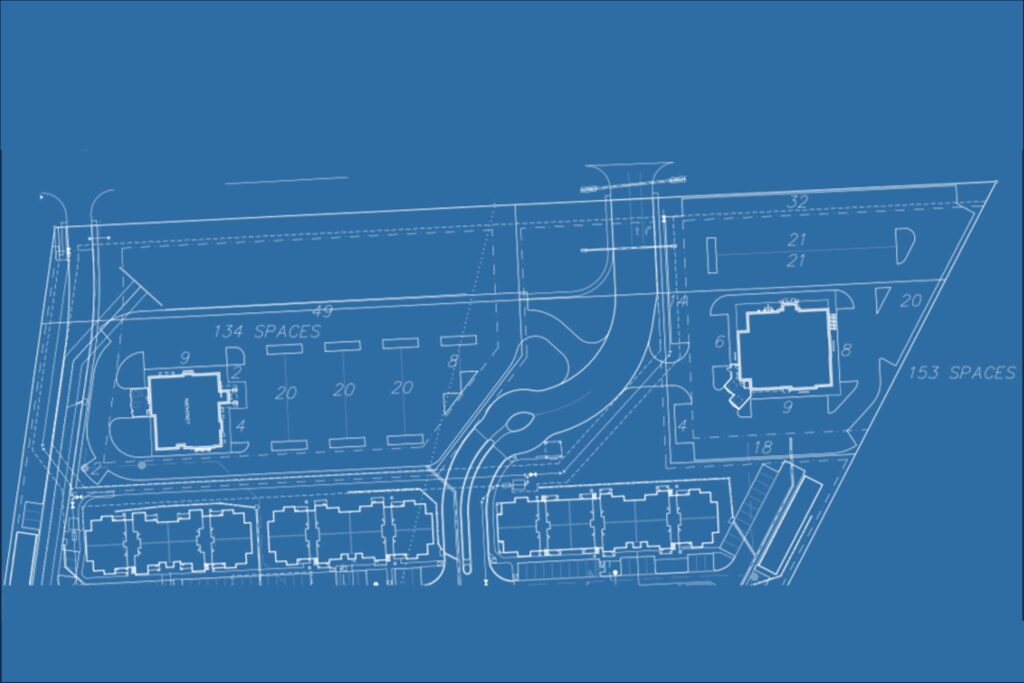

The Shoppes at Grassdale

Manor, Texas

The Shoppes at Grassdale comprise two parcels of 2.71 acres and 1.76 acres zoned for commercial retail use in an OZ. Negotiations are underway with two national restaurant brands.

The Nest

Tyler, Texas

104-unit C Class value-add project. The property is ideally located across from the University of Texas in Tyler and numerous major healthcare employers. Construction was completed in 1982.

The Foundry

Fort Worth, Texas

167-unit C Class value-add project situated in an area of rapid regentrification and growing high-end retail businesses in the heart of west Fort Worth. The Foundry was completed in 1974.

The Stanton Phase I

Lockhart, Texas

140-unit A Class core asset located in an OZ along the explosive tech corridor east of Austin on SH-130. The Stanton is one of Lockhart’s newest multifamily communities. Phase I was built in 2019.

The Stanton Phase II

Lockhart, Texas

The Stanton Phase II picks up where Phase I left off. Phase II will comprise 144 additional units to satisfy the area’s explosive demand for housing. Completion is forecast for the Fall of 2024.

The Station at Howe

Howe, Texas

100-unit C Class value-add asset just two miles south of the Texas Instruments, $30B silicon chip manufacturing facility in Sherman. Westwood Manor’s construction was completed in 1972.

TEAM

Pilot-Legacy possesses vast experience in the areas of deal structuring, capital formation, marketing, construction management, leasing, operational management, accounting, and finance. Pilot-Legacy’s vertical integration allows it to execute on every aspect of a commercial real estate deal.

Whether its working side-by-side with our contractors to ensure the judicious use of time and resources, or overseeing the successful marketing, lease-up and day-to-day operations and management of each asset, Pilot-Legacy’s personnel is in place from start to finish with the focus of maximizing NOI throughout the term of investment.

Ashlee Alexander

Investor Relations

Lane Beene, MBA

Managing Partner

Kai Brubaker

Investor Development

Veanessa Honeycutt, CAPS

Senior Portfolio Manager

Richard Lowe, CCIM

Managing Partner

Sonya Manthe, CAPS

Vice President of Operations

Rodolfo Martinez

Managing Partner

Darvi Moore

Operations

Susie Musso, CPA

Finance & Accounting

Katherin Piedra

Senior Property Accountant

Edwin Sosa

Managing Partner

Michael Walker, CPM

Managing Partner

LEARN MORE

MEET PILOT-LEGACY

TESTIMONIALS

FAQs

Pilot-Legacy possesses a fully-integrated team with decades of experience in the commercial multifamily space. Not only do we have expertise in deal structuring and syndication, but we have our own in-house property management team as well as our own construction and maintenance specialists. This integration ensures the management and maintenance of each asset are prioritized for our investors while being executed at the best price point.

We target income-producing, multifamily properties in the “Texas Triangle” — that region subtended by San Antonio, Houston, and Dallas/Fort Worth. We seek out opportunities which offer attractive value relative to the same class asset operating at the prevailing market rate. We seek opportunities with the potential for value-add through capital improvements, enhanced management, or through pre-emptive market positioning.

We underwrite each investment with an anticipated five (5) year investment horizon. We may sell sooner or later, depending upon whether or not we achieve the desired returns while remaining thoughtful of the projected market conditions.

Pilot-Legacy seeks investment opportunities that will provide investors with a cash-on-cash return of 8-10%, an IRR of 17-20%, and an equity multiple of 1.5-2x. Sometimes a property will cashflow well, but realize a lower equity multiple upon sale. While other times a property will not cashflow well, but will have a much more rewarding capital event upon sale. Operational parameters and market conditions during the cycle of the investment can and do differ from that which was initially projected, thereby altering returns.

Members of Pilot-Legacy have vast development experience as part of their real estate portfolio. Pilot-Legacy recently completed a 320-unit, ground-up development in Manor, Texas under the Qualified Opportunity Zone incentive. This project was a $52 million dollar project completed on time and on budget. The Grassdale in Manor is operating at full capacity and performing well above the investor pro forma. Here’s The Grassdale Project – Start to Finish. You can glean additional insights into our ongoing ground-up development in Lockhart, Texas here.

We organize each Pilot-Legacy investment under SEC Regulation D, Rule 506(b). Under Rule 506(b), Pilot-Legacy can permit up to thirty-five (35) non-accredited investors, and an unlimited number of accredited investors.

One or more of the following criteria will satisfy a Subscriber’s assertion of accreditation:

- A natural person whose “net worth,” either individually or jointly with Subscriber’s spouse, exceeds $1,000,000, excluding the value of their primary residence;

A natural person who had an individual “income” in excess of $200,000, or joint income with Subscriber’s spouse in excess of $300,000, in each of the two most recent years and has a reasonable expectation of reaching the same income level in the current year;

A bank as defined in Section 3(a)(2) of the Securities Act, or any savings and loan association or other institution as defined in Section 3(a)(5)(A) of the Securities Act, whether acting in its individual or a fiduciary capacity;

A broker or dealer registered pursuant to Section 15 of the United States Securities Exchange Act of 1934;

An insurance company as defined in Section 2(13) of the Securities Act;

An investment company registered under the Investment Company Act of 1940 (the “Investment Company Act”) or a business development company as defined in Section 2(a)(48) of the Investment Company Act;

A Small Business Investment Company licensed by the U.S. Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958;

A plan with total assets in excess of $5,000,000 that has been established and is maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees;

An employee benefit plan within the meaning of the United States Employee Retirement Income Security Act of 1974, as amended: (i) the investment decisions of which are made by a plan fiduciary, as defined in Section 3(21) of such Act, that is a bank, savings and loan association, insurance company, or registered investment adviser; (ii) which has total assets in excess of $5,000,000; or (iii) which is a self-directed plan the investment decisions of which are made solely by persons that are accurately described by one or more of the criteria listed herein (excluding this item (9) and item (15));

A private business development company as defined in Section 202(a)(22) of the Investment Advisers Act of 1940, as amended;

An entity that: (i) has total assets in excess of $5,000,000; (ii) was not organized or reorganized for the specific purpose of acquiring the Units or any other interest in the Company; and (iii) is a corporation, partnership, limited liability company, organization described in Section 501(c)(3) of the United States Internal Revenue Code of 1986, as amended (the “Code”), or a Massachusetts or similar business trust;

A director, executive officer or general partner of the Company;

A trust that: (i) has total assets in excess of $5,000,000; (ii) was not organized or reorganized for the specific purpose of acquiring the Units or any other interest in the Company; and (iii) is directed, for purposes of acquiring the Units, by a sophisticated person who has such knowledge and experience in financial and business matters that such person is capable of evaluating the merits and risks of investing in the Units;

A revocable trust, all of whose grantors qualify under any of items (1)-(13). If Subscriber belongs to this investor category only, a list of the grantors of Subscriber, and the investor category which each such grantor satisfies, should be included with the assertion of accreditation;

An entity (other than a trust) in which all of the equity owners qualify under any of the foregoing items (1)-(13). If Subscriber belongs to this investor category only, a list of the equity owners of Subscriber, and the investor category which each such equity owner satisfies, should be included with the assertion of accreditation; Note: The list described in item (15) need not be provided if Subscriber is accurately described by one or more of the foregoing items (1)-(13).

Under SEC Reg. D, Rule 506(b), investors perform a self-accreditation during the subscription process. The accreditation of an investor must only be verified by Pilot-Legacy under Rule 506(c). We presume investors are candid about their accreditation.

Pilot-Legacy requests a minimum investment amount of $50,000. In some circumstances, we can waive this minimum amount. Please call Pilot-Legacy to discuss your circumstances if you wish to invest below the minimum amount. Note: If your investment involves an exchange under IRC sec. 1031, please refer to the frequently asked question posted below which addresses that subject matter.

Pilot-Legacy permits foreign investors of all nationalities to participate in our investment offerings.

Pilot-Legacy has access to a team of legal and tax professionals who are prepared to assist taxpayers of all nationalities in meeting their filing obligations under the law. We can work with you and your team to assist with your unique requirements.

Pilot-Legacy will assist investors with 1031 exchanges. However, due to the significant legal coordination and expense associated with such an exchange, we require exchanges of at least $250,000. We can accommodate lower amounts if the investor is willing to defray the legal costs of the exchange. Please contact us to discuss your particular situation.

Although Pilot-Legacy’s flagship investment–The Grassdale at Manor–is a QOZ investment, we do not have any QOZ offerings at this time.

Proceed to the investor portal by clicking on the “INVESTORS” tab located in the menu bar at www.pilot-legacy.com. If you do not have an investor profile with us, click on the “Create Account” link and provide the requested information. When complete, select the “SIGN UP” button and a verification email will be sent to you. If you do not see the verification email, check your spam, junk, or promotions (Gmail) folder. Once you have an account with Pilot-Legacy, login with your email address and password to access the Pilot-Legacy investor portal. There you will be able to access active offerings and invest. When an offering is active, investors will be able to access the Operating Agreement (OA), the Private Placement Memorandum (PPM), and the Subscription Agreement (SA). The OA describes how the company sponsoring the investment will operate. The PPM presents the details associated with the issuance of company interests through investment and the issuance of “units” which represent those interests. Finally, the SA is the electronic document wherein investors submit an assertion of accreditation and commit capital to purchase the units representing an interest in the investment.

Maintaining the integrity and security of our investors’ data is a priority for Pilot-Legacy. We follow industry standards and address security in three major components: physical security, corporate IT security, and production security. Learn more by reviewing our Privacy Policy, which is available here.

Due to the increasing complexity associated with partnership taxation and the burden that many tax and accounting firms undergo in the preparation of K-1s, these forms seem to be issued later and later every year. We understand this greatly impacts the filing of investors’ individual tax returns. At Pilot-Legacy we do our best to submit our data to our tax team as soon as its available following its reconciliation after New Year. We make every effort to issue K-1s by March 15 of each year. Please know that we make every effort to execute on time and meet this March 15 deadline. If we are going to breach that deadline, we will inform our investors.

Ensure you are on our email distribution list and follow us on social media. As soon as we have a new investment opportunity, we send out the details via email as well as through Facebook, Instagram, and Linkedin.

PARTNERS